Federal Tax Policy

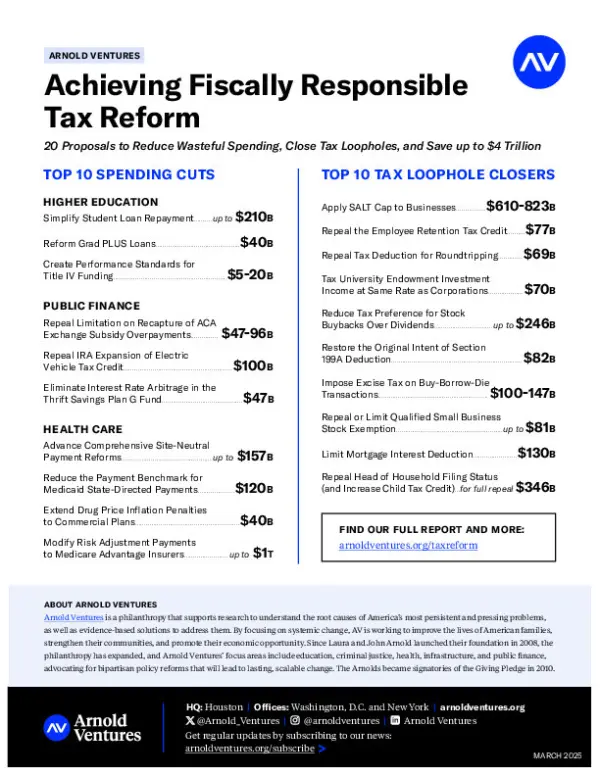

Smart tax policy balances the goals of fiscal sustainability, maximizing opportunity, and minimizing injustice.

Today’s tax code is complex and easily exploited by those who have the resources to navigate it — whether it be by U.S.-headquartered global firms or by wealthy individuals finding windfalls through poorly designed incentives. Provisions meant to help families need reform to ensure they are achieving their goals effectively and efficiently.

Our tax policy work is concentrated in four key areas. First, make the structure and administration of the Child Tax Credit more effective and efficient. Second, balance the competing priorities of protecting the U.S. corporate tax base from erosion via profit-shifting and enhancing the ability of U.S.-headquartered corporate groups to compete in foreign markets. Third, ensure place-based incentives like Opportunity Zones are effective and efficient in revitalizing low-income communities and enhancing opportunity while reducing unintended windfalls. And finally, reduce opportunities for inappropriate tax avoidance by high-net-worth individuals, especially with respect to income from capital.

Image: Getty Images

Stories

See all

Resources

See allMeet the Team

All People

George Callas

Executive Vice President of Public Finance

Eva Conway

Director of Public Finance – Chief of Staff

Douglas Criscitello

Program Integrity Fellow

Hana Greenberg

Vice President of Advocacy, Public Finance

Scott Hodge

Tax and Fiscal Policy Fellow

Andrew Moylan

Vice President of Public Finance

Sara Ragsdale

Public Finance Analyst

Lynn Riesett

Executive Assistant (she/her)

Anna Tyger

Public Finance Manager

Quang Vu

Grants Manager (he/him)