Responsible Tax Reform

Let’s put more money back in hardworking Americans’ pockets – by extending tax cuts to spur economic growth and finding responsible ways to pay for them. Congress Can Do Both.

Congress is facing tough decisions about how to deal with the expiration of many crucial but expensive tax reforms. By protecting the tax relief Americans rely on while closing loopholes and enacting targeted spending reforms, we can do both: promote economic growth without adding to the deficit and set our economy up for success without pushing the cost onto future generations.

The unsustainable federal budget imposes a massive financial burden on hardworking Americans – today and in the future. We are bankrupting the next generation – and higher debt means more inflation and less to invest in areas that can fuel local economic growth, like innovation, infrastructure, and wages. We owe it to ourselves and to future generations to be more responsible with our spending and rein in debt.

We have an opportunity to act responsibly – preserving tax cuts that spur economic growth and doing so in a way that doesn’t increase the unsustainable debt. We can decide now to either saddle future generations with mountains of unsustainable debt, or set us and them on a path of success – by stimulating short- and long-term economic growth and more private investment in areas like education, innovation, and infrastructure.

If we want to improve our country, we can’t always do things the same old way. 2025 represents a unique opportunity in America to invest in our present without bankrupting our future. It’s time to stop irresponsible and unaccountable Washington spending. Yes, let’s extend key tax cuts that Americans rely on, and let’s find ways to pay for those tax cuts – so we don’t repeat our spending mistakes of the past.

It might take more work, but it’s work worth doing.

Image: (Anna Moneymaker/ Getty Images)

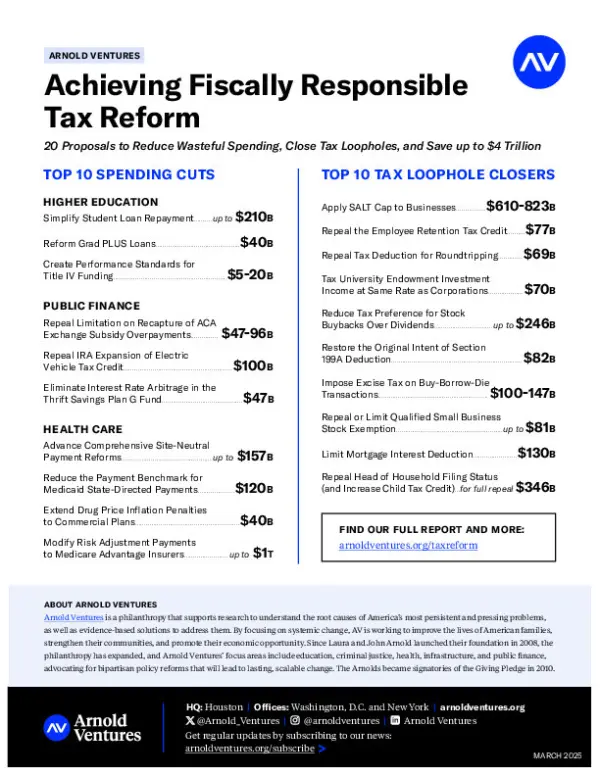

Achieving Fiscally Responsible Tax Reform

This report presents 20 priority reforms — 10 spending cuts and 10 tax loophole closers — that would generate up to $4 trillion in savings to help advance the permanent extension of the TCJA without adding to the deficit.

Learn MoreStories

See all

Resources

See allIn the News

George Callas On Spending Cuts and Loophole Closers on Bloomberg’s Balance of Power

George Callas, Executive Vice President of Public Finance at Arnold Ventures, discusses the AV’s report on 20 spending cuts and loophole closures that can help make the TCJA permanent without increasing the deficit.